Last updated on December 3rd, 2024 at 05:10 pm

Freelancers usually get confused about money, taxes, and business entities. Let’s talk about these things. One question I get from Freelancers is does my business need its own bank account?

For freelancers, a dedicated self-employed bank account is a must-have. Here are the 7 best self-employed bank accounts.

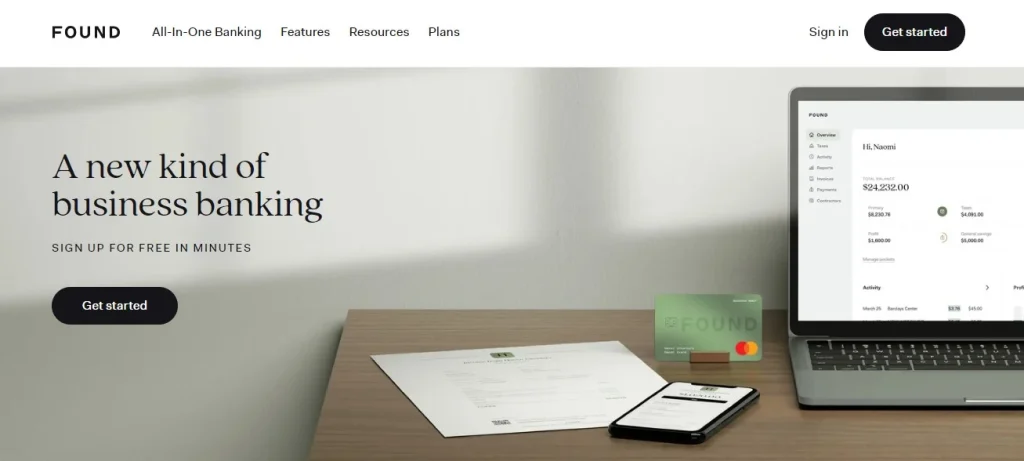

1. Found Banking

In the first list, we have Found, an all-in-one banking solution for freelancers and self-employed individuals. Found does not charge account fees, no monthly minimum, and no credit checks.

They also provide real-time profit and loss statements, expense and income reports, expense categorization, receipt logs, and invoices. Found is much more than a traditional bank account.

It’s a combination of bookkeeping, invoicing, and banking. With this app, you can set aside taxes automatically, so you have plenty of cash when taxes are due.

In addition to getting a Schedule C report and paying taxes right from the app, Found is a very good banking solution for freelancers and solopreneurs.

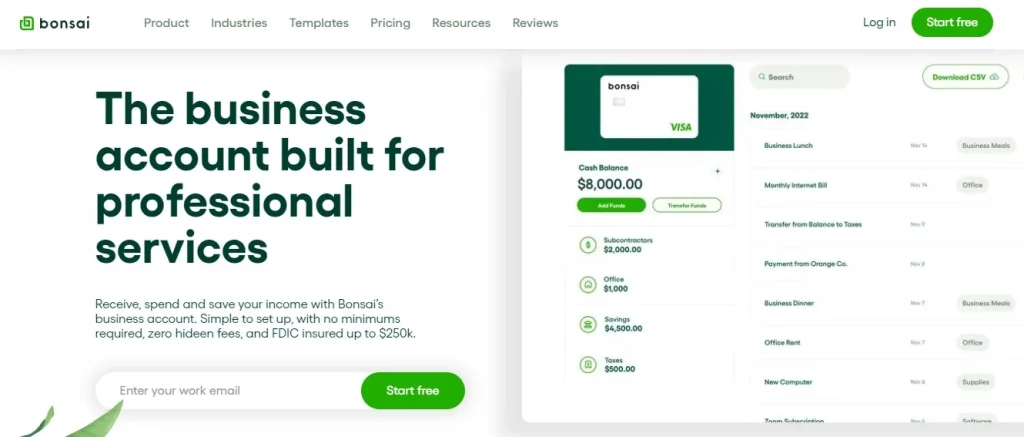

2. Bonsai Cash

Bonsai Cash is another option for freelance banking. We love Bonsai for its freelance productivity tools, such as invoicing, proposals, and contracts.

Bonsai Cash is now offering a business checking account specifically designed for freelancers. We like Bonsai Cash’s envelope feature because it helps you organize your money into categories.

To manage your freelance finances, you can create as many envelopes as you want. Moreover, you can connect Bonsai cash to Bonsai payments or other sources to get paid directly. You can also use your virtual and physical cards to spend your funds.

3. Lili Banking

We’re moving next to Lily, a bank that saves time, money, and energy for people who run their businesses.

Lily does not require a minimum balance, doesn’t charge hidden fees, and offers zero-fee ATM withdrawals at 38,000 Plus locations without any fees.

In addition, they offer competitive spending limits for mobile check deposits and a Visa debit card for businesses that reward you with cashback.

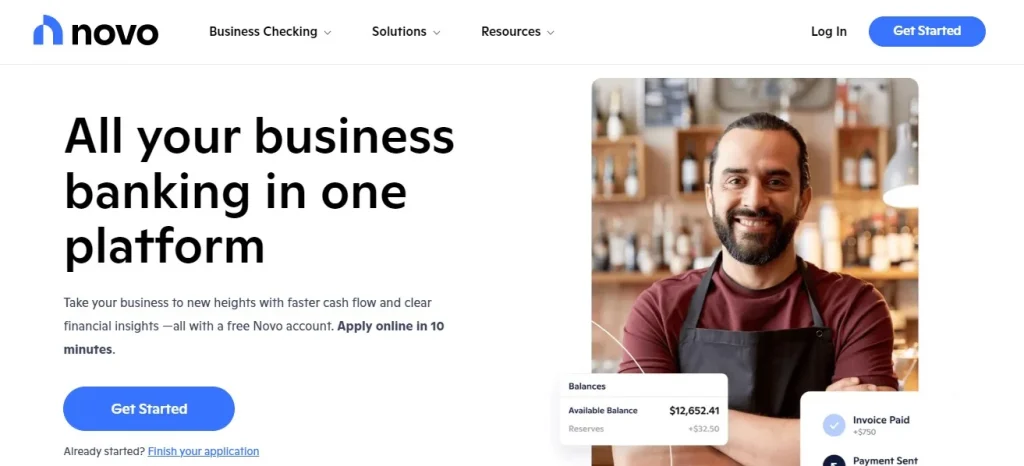

4. Novo Bank

Next up is Novo, a self-employed banking solution available only online. Invoices can be paid directly to your Novo account, so you don’t have to wait for funds to transfer into your account.

You can also pay your bills in the account with transfers or paper checks. However, Novo does not yet have a recurring bill-pay option. Each month, you must pay your bills separately.

There is a charge of twenty-seven dollars each time there are insufficient funds in your account, which can be a real bummer.

5. Nearside Bank (Closed)

We next examine Nearside, which doesn’t charge a monthly fee, does not charge for overdrafts, and does not require a minimum balance.

The near-side small business bank account offers simple mobile payments through Apple Pay or Google Pay and unlimited cashback of 2.2%, plus no monthly fees.

Furthermore, nearside can help you form an LLC and assist with other small business needs.

6. Oxygen Bank

Freelancers can also use oxygen for their freelance banking needs. You can earn one percent interest on any savings you keep in your business account each year by saving five percent cash back on everyday business purchases like gas, ridesharing, shipping, and more.

7. Chase Bank for Small Business

As a final recommendation, if you are looking for something more traditional but reliable, we recommend Chase Bank. They cater to larger businesses or personal finances.

Chase offers a pretty nice small business account for freelancers and self-employed individuals.

The Chase business checking account offers all the perks of a big bank, but also some downsides, like higher fees and less flexibility. Plus, if you open one, you’ll earn $300 in rewards.

Conclusion – Best Bank For Freelancers

Those are the seven best bank accounts for freelancers and self-employed entrepreneurs on our list. Ultimately, it’s all about what you need for your freelance business, and you can always switch banks later if you need to. So jump right in and give one a try and see for yourself.