Last updated on April 12th, 2024 at 11:11 am

Greetings guys, welcome to another episode of my credit card series. During this episode, we will discuss the best credit cards available to freelancers and self-employed people. Let’s discuss why self-employed or freelancers need credit cards.

Why do freelancers and self-employed people need credit cards?

In most cases, these people generate a lot of money by themselves, usually as a one-man army or as a small team. Most of their expenses can be considered business expenses.

Now if you put most of your expenses on a credit card you get a lot of points and you can use those points in your personal life to save a lot of money.

How To Pick The Best Freelancers Credit Card

You should consider several factors when picking a business credit card, such as your spending, business type, and size, rewards goals, interest rates, and credit score.

1. Business Type and Size

If you have two employees, you may want to look for a credit card that offers free employee cards. Your business type should be a key consideration when choosing a business credit card. A credit card that doesn’t cap spending and carries rewards and bonuses might be necessary for a larger business that has more spending.

2. Spending

When choosing a credit card, think about the categories you’ll spend the most money on. For example, if you’re a rideshare driver who fills up your tank frequently, a card with additional gas points or cash back is best for you.

The right credit card can guide you to the right credit card if you’re setting up a home office. Consider how much money you’ll spend in each category, and that can guide you.

3. Interest Rates

It’s especially important to get a 0% introductory APR for new business owners or freelancers who are just getting started. If you want to avoid skyrocketing APRs after the intro period, as many of these cards do, be sure to pay off your bill as soon as possible.

4. Rewards Goals

As a business owner, what is most important to you: points or cash back? How important is it to you to have access to lounges or to have car rental insurance?Consider the potential perks and decide what benefits you most in both your personal and professional lives.

5. Credit

What business credit cards you can get will probably be impacted by your credit score, whether you like it or not. Through a business card, you might be able to build business credit, which could lead to a more premium business card in the future.

Why do freelancers and self-employed people have difficulty getting credit cards?

When it comes to getting a credit card, it’s usually a little more difficult for someone who is not salaried, but who is self-employed. On every credit card website, you’ll see that the eligibility criteria for salaried people are very low, while the criteria for self-employed people are slightly higher.

It is because they believe self-employed individuals have a greater degree of risk, so if I give them a credit card today, that person might not have that kind of money tomorrow, since he or she is self-sufficient.

In any case, if you are self-employed, and if I am self-employed, I would have a credit card and use all my expenses on the credit card to maximize my points. It doesn’t matter if it is a business expense or a normal expense.

Today, I will show you a few credit cards we can use. This is for freelancers who don’t make a lot of money, so you don’t want to pay a high joining bonus, so you might not qualify for all the high cards.

As a result, I will show you two to three small cards that you can use, as well as another business card that you can use. You will earn the maximum amount of points and get some big benefits as well.

5 Best Credit Card for Freelancers

1. Business Unlimited Credit Card

The first is the Ink Business unlimited credit card. It’s a great option for freelancers, and why? Because they offer a simple 1.5% return on all purchases.

I think everyone loves cash back these days because we buy so much online, right? In addition to Stellar’s welcome bonus, they also offer excellent Ultimate Rewards cards. You do not have to pay annual fees if you use this card.

The APR on purchases is zero for the first 12 months, so this is a good card for most Freelancers.

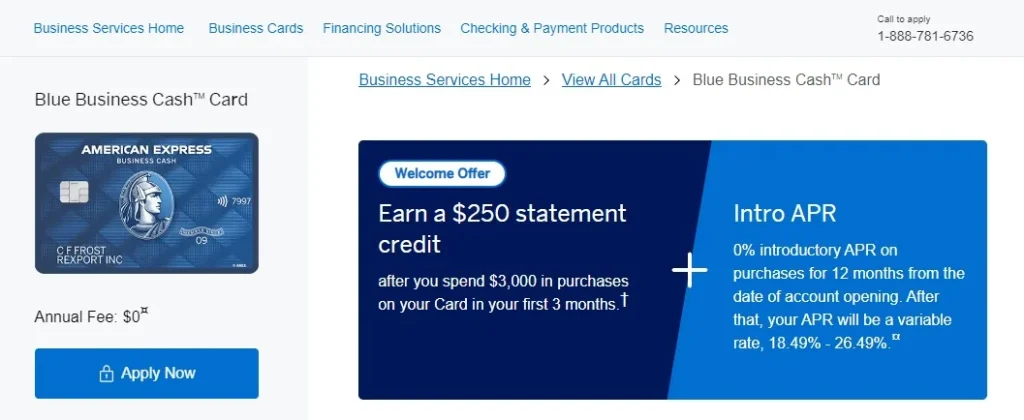

2. American Express Blue Business Cash Card

I’m going to introduce you to the next card, the American Express Blue Business Cash Card. Who will benefit from this?

Would anyone who’s just starting as a freelancer be able to use this? For the first 12 months, you will receive a flat 2% cash-back reward on the first $50,000 in purchases.

Third, there are no complicated benefits, so it’s very straightforward and transparent. For the first 12 months, you will get zero intro APR.

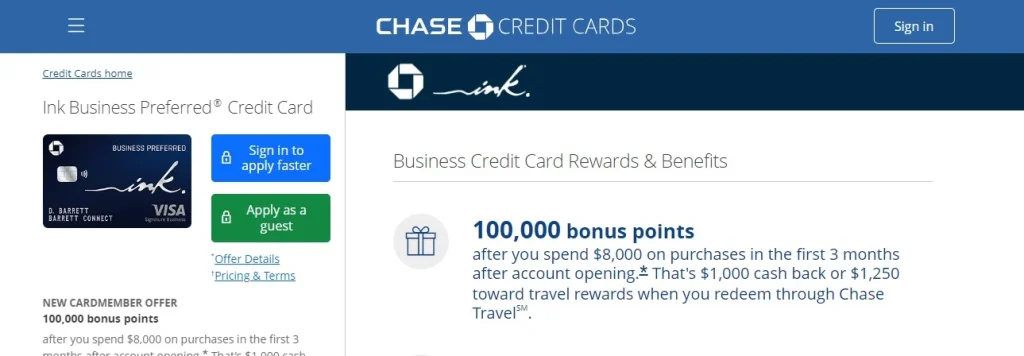

3. Ink Business Preferred Credit Card

The third card is the Ink Business Preferred Credit Card. The card is perfect for freelancers who want travel rewards.

The benefits of this card are that it rewards you with Chase Unlimited I Chase Ultimate Rewards. The second is a versatile travel rewards card that offers cash back on travel bookings and transfers to loyalty programs.

The third gives freelancers three times the points on certain categories that cover common freelancer purchases.

Last but not least, if you love rewards, this would be the right card for you. Also, if you like to travel, this would be a great card for you.

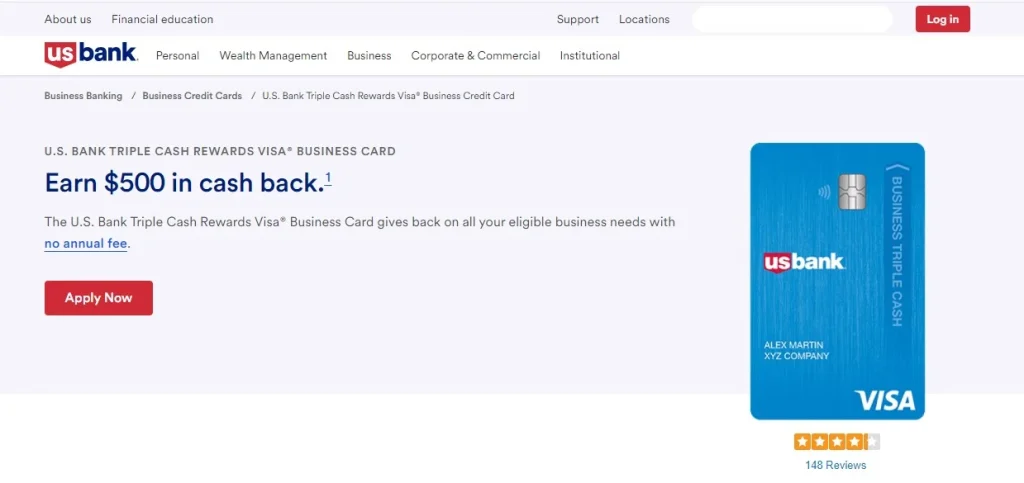

4. US Bank Triple Cash Rewards Visa Business Card

The fourth card is the US Bank triple cash rewards Visa business card. Is this a good choice for those looking for a cash-back card with no annual fee?

As with the other three cards, this card is free of annual fees. It offers 0% interest for 15 months on purchases, and allows balance transfers.

Finally, they offer a generous welcome bonus and a 3% transfer fee with a minimum of $5.

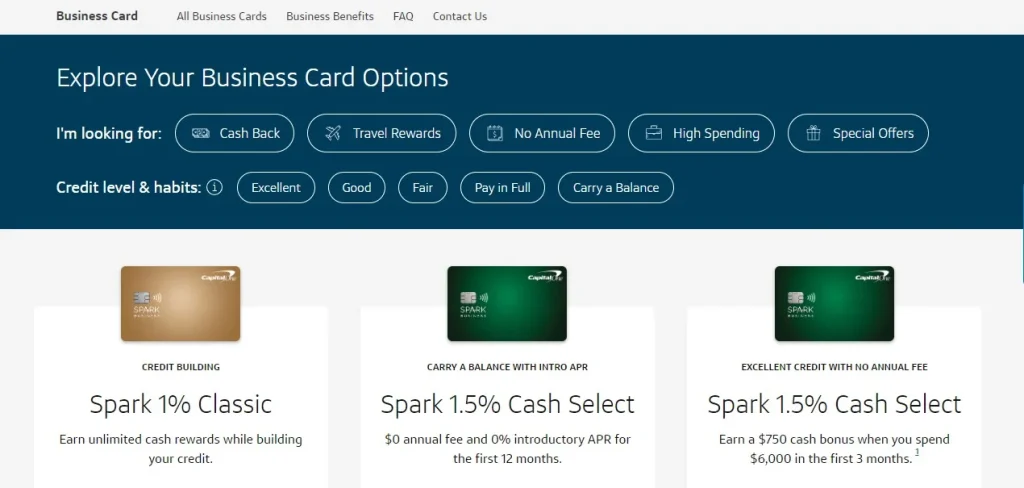

5. Capital One Spark Business Card

We’ll have Capital One as our last card. This is a Capital One Spark 1% Classic that can be used by individuals or freelancers with a credit score of 580 or higher.

What are the benefits of using this card? You can earn 5% back on hotels and rental cars booked through Capital One Travel, as well as 1% back on everything else.

The reason I say this is that they all offer a lot of rewards, a lot of cash back, and a lot of other benefits.

Conclusion

You just need to choose which card fits you the best, such as the card that fits your needs best.

In addition to offering Simplicity travel rewards, cash back, credit building, and introductory offers, each of these cards is designed to cater to a different need.

Choose the one best suited to your financial situation and freelancing goals.

Frequently Asked Questions (FAQs)

Can freelancers get credit cards?

Yes, freelancers can obtain credit cards for their personal and business needs. Your personal credit score may be used in determining your creditworthiness if this is your first business credit card.

Can I use my business credit card for personal expenses?

When you open your business credit card account, the terms state that you can only use the card for business expenses, so you shouldn’t use it for personal expenses. Although this is a gray area and banks may not be able to prove charges were business expenses, it is best to spend the card on business expenses.

Why should self-employed individuals and freelancers use credit cards?

Having a credit card for self-employed or freelancers offers several advantages, including easier expense tracking, access to cash flow during lean months, and building a credit history.

How do self-employed people select a credit card?

Self-employed individuals should look for credit cards that offer customizable spending limits, rewards for business-related expenses, low annual fees, and tools for organizing expenses.

Do freelancers and self-employed individuals have specific credit cards?

Yes, there are several credit cards designed for freelancers and self-employed individuals, offering perks like higher cashback rates on business expenses, flexible payment terms, and rewards tailored to their needs.

What are the benefits of credit cards for freelancers?

Since credit cards allow freelancers to separate business and personal expenses, track spending, access short-term financing, and build credit, freelancers can easily manage their finances.

Is there a downside to using credit cards for self-employed people?

Self-employed individuals need to be aware of the drawbacks of credit cards, such as high-interest rates, late payment fees, and overspending, which can lead to debt accumulation if not managed properly.